Finding the right childcare solution can feel like a full-time job, especially when you’re balancing budgets, schedules, and what’s best for your little one. One increasingly popular option for families is a nanny share, where two (or sometimes more) families share the services, and cost, of a single nanny.

It can be a win-win: the nanny earns a higher hourly rate than they would caring for just one family, while each family pays less than they would for a private nanny. The kids get built-in playmates, and parents get trusted, flexible care at a more manageable price.

But before you dive in, here are key things to consider to make your nanny share a happy and sustainable arrangement for everyone involved.

1. Align on Values and Parenting Styles

A nanny share works best when both families are on the same page about the big stuff — routines, discipline, nap schedules, screen time, meals, and the day-to-day rhythm of your kids’ lives.

Before hiring anyone, have an open, honest conversation with the other family about your parenting philosophies. It’s easier to work out differences now than to navigate them after the nanny has started.

2. Decide on the Logistics Early

Some key questions to settle:

- Where will care take place? Will it alternate between homes, or always be in one location?

- What’s the daily schedule? Make sure both families agree on drop-off and pick-up times.

- Who provides what? Think high chairs, strollers, snacks, car seats, and even baby wipes.

Writing these details down helps avoid misunderstandings later.

3. Nail Down the Financial Details

Important financial details to discuss include:

- The nanny’s hourly rate and how it will be split.

- How overtime, holidays, and paid time off will be handled.

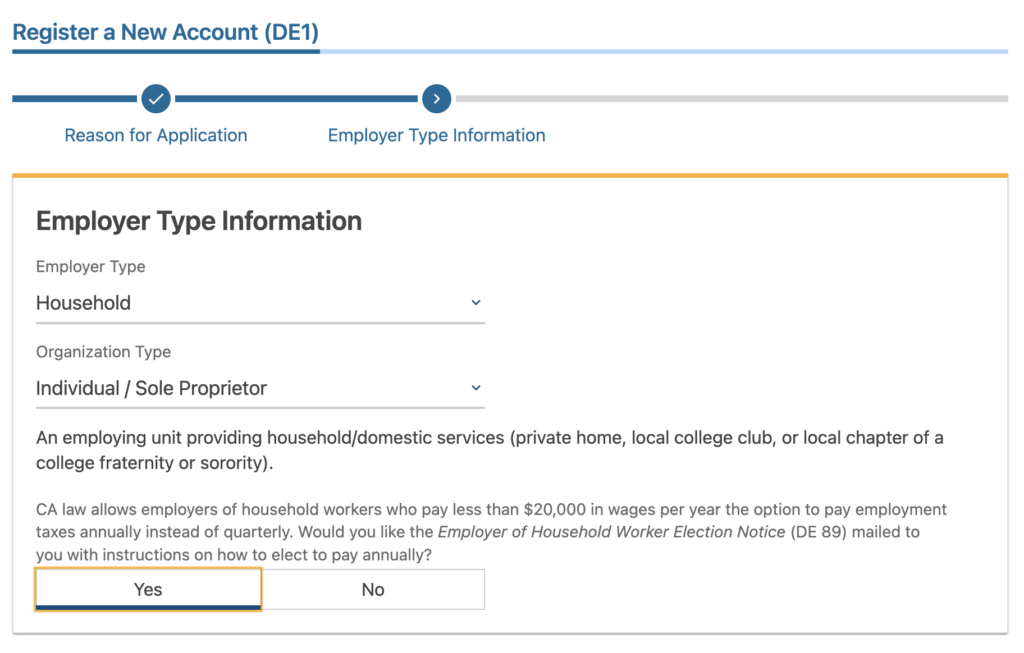

- Who’s the employer of record for tax purposes (one family, or each family separately?). The cleanest way to go about this is that each family separately employs the nanny.

Each family should understand their household employer responsibilities, including payroll taxes and any benefits. The Paycheck Nanny app can make it simple to calculate take-home pay, taxes, and overtime for your nanny share arrangement.

4. Put It in Writing

Even among close friends, a written agreement keeps expectations clear and relationships strong. A solid nanny share agreement should include:

- Work hours and pay details

- Duties and responsibilities

- Vacation, sick time, and holidays

- Termination and notice periods

- Illness and emergency policies

You can start with a simple template and tailor it to your situation. Below is an example nanny share agreement as a starting point.

5. Prioritize Communication

Nanny shares thrive when everyone stays connected. Set up a shared group chat or weekly check-in between both families and the nanny to discuss schedules, routines, and any concerns.

Regular communication helps small issues stay small and shows your nanny that you value her perspective.

6. Treat Your Nanny Like the Professional She Is

A nanny share is still a professional arrangement. Make sure your nanny receives fair pay for caring for multiple children, and that expectations are clear about what’s included in her role. Provide paid vacation, sick leave, and holiday pay whenever possible. It’s not only fair but also improves retention and morale.

Final Thoughts

A nanny share can be a wonderful childcare solution. It can save money, create lasting friendships, and give your kids a caring, social environment.

Take time upfront to align with your partner family, treat your nanny well, and put it all in writing and you’ll be setting up your nanny share for success.

Bonus Tip: Simplify Payroll with the Paycheck Nanny App

Keeping track of hours, overtime, and taxes can be the hardest part of managing a nanny share. The Paycheck Nanny app helps parents calculate paychecks, taxes, and take-home pay instantly — no spreadsheets required.

Whether you’re the primary employer or sharing costs with another family, Paycheck Nanny takes the guesswork out of paying your nanny legally.