It’s tax time again! If you had a nanny, babysitter, or any household employee last year, you need to file Form 5471 Schedule H with your tax return if you answer yes to any of the following.

In the 2023 tax year, did you:

- pay any one household employee cash wages of $2,600?

- withhold federal income tax for any household employee?

- pay total cash wages of $1,000 or more in any calendar quarter to all household employees?

What this form does is capture how much you have paid to a household employee and the taxes you have already withheld. With that, it will determine the amount you owe to be included as part of your personal tax return.

If you are using the Paycheck Nanny app for iOS, your nanny’s gross earnings for Last Year on found at the top of the Pay History tab when the “Last Year” time range is selected.

If you are filing your taxes with TurboTax, H&R Block or other tax software, it will walk you through entering the information needed.

TurboTax captures this information under “Other Tax Situations” and requires TurboTax Deluxe to complete this form. If using the TurboTax free edition, it will prompt you to upgrade if you indicate that you had a household employee last year.

If you are not using tax software, you can alternatively download the Schedule H itself and also the Instructions for Schedule H from the IRS website.

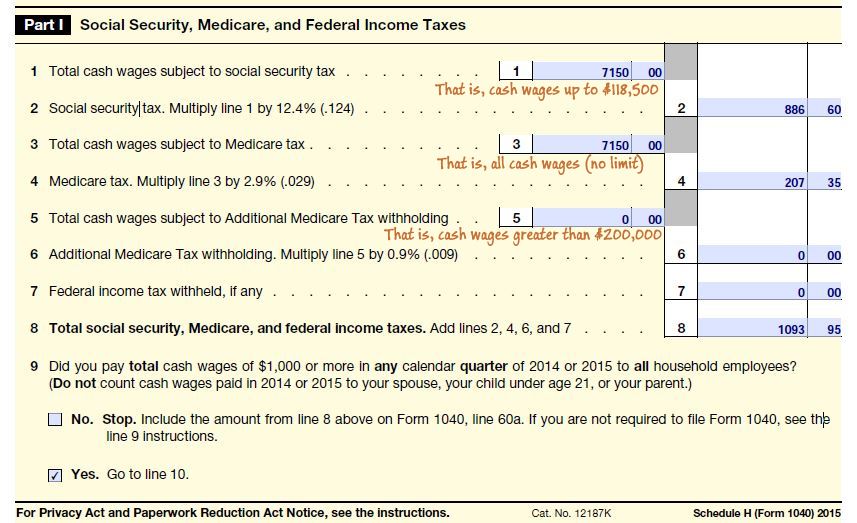

Schedule H – Part I

Below is an example of what Part 1 of Schedule H looks like when filled out, with some hints added in-line. This example is for a nanny who worked during school vacations and made $7,150 gross cash wages. While the forms below walk through an example from a prior year, Form Schedule H with your 2023 tax return will look similar, except that the limit for item 1 (Total cash wages subject to social security tax) has increased.

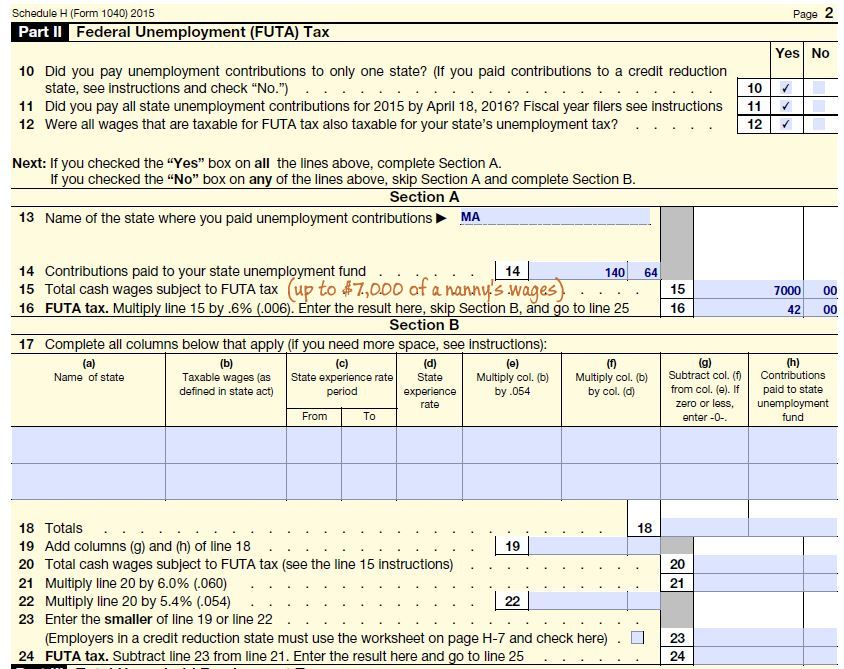

Sch H – Part II

Part II calculates Federal Unemployment (FUTA) tax owed. The calculations will vary depending on your state. For the 2023 tax year, California, New York, and the US Virgin Islands is considered a “Credit Reduction State” for Federal Unemployment (FUTA) Tax purposes. If you have employed a nanny elsewhere, skip to the section for FUTA for all other states.

FUTA for CA, NY, & US Virgin Islands

For California, New York, or US Virgin Islands, in Schedule H – Part II, leave Section A blank and fill out Section B instead. Note the states which are ‘credit reduction states’ varies from year to year.

FUTA for all other states

For all other states, you will be paying .6% (.006) of your nanny’s first $7,000 wages in FUTA. So this means the maximum amount of FUTA you will need to pay is $42 for the year. Below is an example from Massachusetts, a non-credit reduction state. Notice if you can answer No to questions 10, 11, and 12, then you should leave all of Section B blank.

Schedule H – Part III

Than after you fill in the calculations in Part III, this Schedule H and payment owed goes along with your personal 1040/1041 tax filing as part of your yearly household employer duties.

One thought on “How to file Form 5471 Schedule H for nanny taxes”

Comments are closed.