When you have school-aged children and the dog days of summer are winding down, back to school season also brings a new routine. This may mean a babysitter or nanny for before or after school care, or both, during the school year.

If you are a household employer and pay $2,700 or more in 2024 to a nanny or babysitter in a calendar year, then you are responsible for FICA and Unemployment Insurance taxes.

Here is a quick calculator to help determine if you will owe these taxes. Notice the $2,700 minimum is per calendar year and not school year. So if you only use your nanny for the fall, you may not have to worry about these taxes. But if you also paid your babysitter earlier this year, this may put you over the lower threshold.

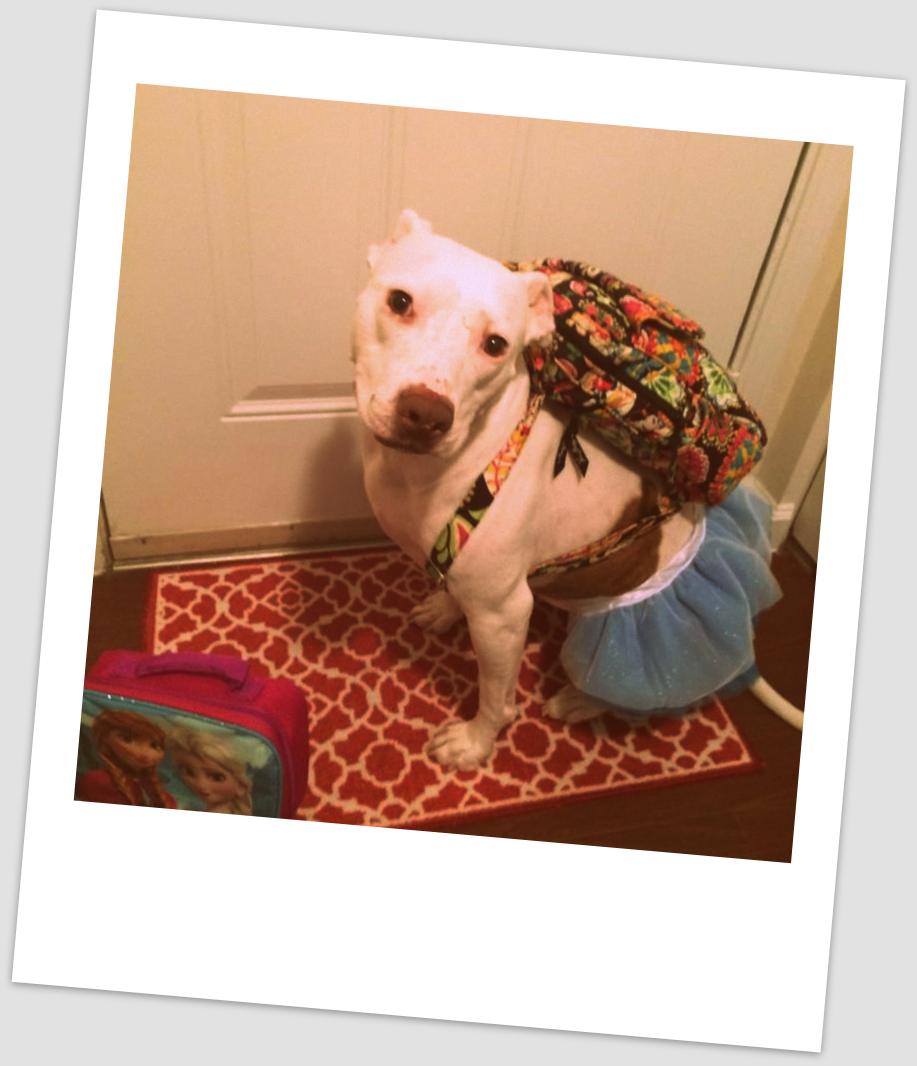

Don’t let taxes get you in the doghouse!

Download our handy app from the Google Play store for Android devices or the App Store for iOS devices to automatically calculate taxes and withholdings, track time, create & email pay statements and guide you through your tax responsibilities.